Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

2023 Global Ecommerce Report: Fashion and Apparel

Pablo Gallaga

2023 Global Ecommerce Report: Fashion and Apparel

Get The Print Version

Tired of scrolling? Download a PDF version for easier offline reading and sharing with coworkers.

A link to download the PDF will arrive in your inbox shortly.

An economic downturn, inflation and the longest online holiday shopping season on record set the scene for the closing months of ecommerce in 2022.

While consumers grappled with the realities of increased prices for goods and services, retailers looked to move inventory and provide deep discounts beginning as early as September. The result in most sectors was increased spending through decreased activity.

From November 1 to December 24 overall U.S. retail sales rose 7.6% year-over-year (YoY), while online sales specifically grew by 10.6% YoY over the same period, according to Mastercard SpendingPulse.

Against this backdrop, we have tracked the performance of the fashion and apparel industry and compiled our findings into a report taking a look at fourth-quarter (Q4) 2022 performance. Read on for BigCommerce’s insights into how this category fared over the last few months.

Our Methodology for this report.

BigCommerce’s fashion data is sourced directly from our customers. All data is global and pertains to all countries where BigCommerce merchants do business, unless otherwise noted.

All comparisons year-over-year are congruent comparisons between the same number of existing stores dating back to the earliest period used in the comparison. For example, a comparison between Q4 2021 and Q4 2022 would use data only from BigCommerce stores that existed in Q4 2021, unless otherwise noted.

How the Fashion Industry Performed in Q4 2022

According to Statista, by November the fashion segment had accounted for $197.3 billion of all U.S. ecommerce revenue for 2022.

The fashion category was up in Q4 2022 YoY versus Q4 2021. GMV grew 17% in Q4 compared to that three-month stretch in 2021. Total orders and AOV both grew by more than 8% YoY.

Additionally, fashion sales through Amazon grew, with more than 31% growth in GMV YoY and saw 27% growth YoY in total orders. Fashion AOV was up nearly 4% YoY.

It was a big quarter for cross-border selling.

The holiday shopping season significantly propped up most regions across all categories through Q4. Fashion grew across all metrics in all regions in Q4 2022. AMER saw almost 16% growth in GMV YoY, EMEA 37% and APAC nearly 12%. Total orders grew 6%, more than 25% and almost 7% for those same regions, respectively.

Consumers shopped more with mobile devices.

The end of the year is a time when most people are on the go or traveling, making mobile shopping all the more prevalent.

The fashion industry’s performance during this time reinforces this cultural trend. Apparel sales through mobile devices were up nearly 20% YoY in Q4 2022, total orders were up 11.5% and AOV was up just over 7%.

Fashion and Apparel Ecommerce Trends

During the holiday season, BigCommerce tracked trends related to holiday spending in our series of Cyber Week reports.

Looking back at Cyber Week specifically — that is the five-day period from Thanksgiving Day to Cyber Monday — fashion was the second-fastest growing category YoY, only behind luggage. It experienced a 66% increase in sales YoY in 2022.

Here are some trends we tracked through the holiday shopping season relating to the fashion and apparel industry.

Checking out checkout.

In the last quarter of the year, Buy Now, Pay Later (BNPL) again emerged as a convenient, flexible option for consumers and drove sales.

We saw an 8% uptick in BNPL usage throughout the month of October in the leadup to the typical holiday shopping season beginning in November. During Cyber Week there was a 25% YoY increase in orders placed using BigCommerce BNPL partners and a 33% YoY increase in GMV using those same partners.

For the fashion industry — and for this metric we include jewelry as part of this category — the trend for usage was largely the same, with nearly a 7% increase in total orders YoY from Q4 2021 to 2022. Sales increases, however, didn’t match the trend with just under a 16% increase in GMV YoY in Q4.

What’s trending in user experience.

2022 brought with it a recognition that monolithic architecture and relying on traditional channels throughout touchpoints of the customer journey results in disjointed experiences for the end user. The necessity for strategy with customer journey intelligence to arrive at a seamless experience through composable user experience (UX) can’t be overstated. And it all starts with an impressive storefront.

Here are the top three trends in ecommerce web design experiences, according to 99designs.

Animated product reveals.

Nothing catches attention more than seeing a product come to life through movement, whether that be an exploded view of all of its components or just seeing it in action.

Immersive experiences/journeys.

In addition to showing off products, giving users a fully interactive and memorable experience can also tip the needle towards sales or at the very least building some love for the brand.

Neo-brutalism.

The off-kilter experience of in-your-face design with more of a utilitarian vibe is another way to capture a consumer’s attention. Neo-brutalism isn’t quite full-blown brutalism, but the asymmetrical layouts and bold use of typography arrive at a similar user experience.

Emerging Trends in 2023

The past year brought with it some reassurance that retailers are on the right track in implementing emerging technology trends. By the numbers, consumers confirmed with their spending dollars that alternate payment methods, streamlined checkout experiences and personalization matter. One thing is clear. You can never go wrong with making things easier on your customers.

Part of continuing to meet consumers where they are is the infrastructure to avoid interruptions of service and to make touchpoints feel seamless. Retailers must make sure their tech stacks are capable for current needs and scalable for future needs.

A case study in growth: Badgley Mishka.

Badgley Mishka, the award-winning global fashion label recognized by Vogue as one of the “Top 10 American Designers,” does business in 272 countries and has inventory in 20 different locations.

Utilizing a number of BigCommerce partners and integrations, Badgley Mishka’s tech stack is more than up to the task, with room to grow.

The company partnered with Feedonomics to expand its omnichannel approach and launched Google Shopping.

Katie Ouaknine, owner of Badgley Mishka Web, recalls the result, “…our business absolutely exploded the second we got on Google Shop…It was way more growth than I was ever anticipating.”

Badgley Mishka’s omnichannel strategy also includes selling through Amazon, Instagram Shop, Facebook Shop and TikTok Shop.

Pairing this with the use of Bolt for one-click checkout, Klaviyo for email automation and Global-e for shipping and fulfillment, Badlgey Mishka has a comprehensive tech stack that positions the fashion label to not only succeed but to comfortably scale as business booms.

Ouaknine paints a picture of what true growth looks like, “We’re breaking our own records month after month. We’ve increased marketing, and we have a ton of integrations with a lot of [BigCommerce’s] partners that have just made our business and our customers more happy, so we’re finding a lot of success.”

A movement towards composable commerce.

Speaking of growth, Forrester research shows that companies committed to a future-fit technology strategy grew revenue 1.8 times faster than their peers.

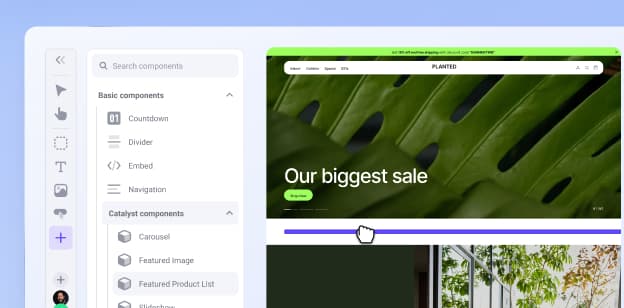

Composable commerce — an approach to tech stacks that involves interchangeable solutions tailored to a business’s unique needs — arrives at the modern architecture that is flexible, open, modular and business-centric.

For fashion brands in particular, composable commerce through a headless architecture makes a lot of sense. It affords untethered design potential for shops that want to show off their wares and personalized shopping experiences that have become the expectation for consumers looking for brands that match or will dictate their style choices.

According to Gartner, by this year organizations that have adopted a composable commerce approach will out pace the competition by 80% in the speed of new feature implementation. In today’s business landscape, that’s what we call a competitive advantage.

Looking Ahead

It’s no secret that the year ahead poses uncertainty in terms of the global economy, but taking that into account, what does 2023 and beyond look like for fashion retailers? Here are the new technologies, trends and cultural factors that could shape the next couple years.

Getting your bearings.

No one would blame retailers for being conservative with their moves right now amid economic headwinds. The first quarter of the year should reveal enough and set the tone for just how careful retailers should be with their investments in new technologies, staffing and inventory.

Economic contractions and recessions are also notorious for spurring innovation and disruption. Taking a cautious approach to finances during such a time would be prudent, but don’t neglect to keep an eye on new players in the fashion space who might be taking a novel approach that snatches away market share.

It’s sink or swim for the Metaverse.

The promises of the Metaverse took ecommerce by storm in 2022, but those prospects have yet to materialize for anyone who is not investing six figures or more into stakes in virtual commodities.

The release of pro model virtual reality (VR) and augmented reality (AR) headsets by Meta and HTC, which provide the advanced tools that are presumed to make the Metaverse more engaging than consumer headsets to date could, have been met with skepticism by the average consumer and even the gaming community. Meta, for one, is still betting big on the prospect of a global virtual community for work, play and commerce.

It’s possible that 2023 is still not the year that the Metaverse will grab a foothold in the average consumer’s daily life, but retailers should get a better idea of whether this will be a thing or not by year’s end and then adjust levels of investment accordingly.

Everything old is new again with resale.

The secondhand U.S. market is expected to more than double and reach $82 billion by 2026 according to a survey by ThredUp. Retail Dive reports that by 2031, re-commerce brands are expected to make up 18% of the apparel industry and nearly 75% of retail executives either currently offer or are open to offering secondhand goods to customers.

In an industry as concerned with sustainability as fashion and apparel is, this is a trend to monitor.

Prepare for a longer holiday shopping season.

2022 was the longest holiday shopping season we’ve ever seen, and there’s little indication that trend will slow down. Fashion retailers should build into their strategy for the year everything they’ll need to be prepared for high demand as early as September.

Also, don’t sleep on Halloween. According to the NRF, Halloween spending hit a record $10.6 billion in 2022. It has become a cultural phenomenon among Millennials and Gen Z who like to put together multiple outfits and costumes for spooky season.

The Final Word

Fashion retailers have an interesting year ahead of them. Though BigCommerce fashion merchants lagged behind the combined BigCommerce merchant field in Q4 2022, there’s still encouraging performance there.

Taking stock of the emerging trends outlined above and forming a strategy that utilizes the integrations and partners that BigCommerce enables will best position fashion retailers for a competitive 2023.

In our next Global Ecommerce Report we will take a look at the performance of the home and garden category.